VANCOUVER, BC / ACCESSWIRE / December 6, 2019 / ZoomAway Travel Inc. (TSXV:ZMA) (the “Company” or “ZMA”) www.zoomaway.com, a leader in the hospitality technology sector, is providing an update today, following up on its earlier press release of October 3rd. The Company had made an application for price reservation for a proposed issuance of convertible notes, but the timeline to close that proposed financing has now expired. The Company will be re-applying today to again reserve pricing for such convertible notes and continues to work towards completing this proposed financing.

Similar to the Company’s earlier disclosure, the Company is negotiating a convertible debt financing which would involve the issuance of up to US$750,000 (approx. CAD$1,000,000) of Convertible Notes. Such Notes may be issued in tranches and will are expected to be convertible into Common Shares of the Company at a conversion price of CAD$0.08 per share in the first 12 months following issuance and convertible at CAD$0.10 per share for the next 12 months following their date of issue. The Notes will be issued for a 2-year term. The Offering is being structured for the existing lender, likely on terms similar to the offering of Convertible Notes completed in April 2019. Again, the Offering and its terms are subject to TSX Venture Exchange approval. It is not expected that any of the Directors or Officers of the Company, or their associates, will be purchasing Convertible Notes. Net proceeds from the Offering will be used for general working capital, continued development, and next stage marketing and sales efforts of its flagship product, ZoomedOUT.

Sean Schaeffer, CEO of Zoomaway Travel, commented, “We have not yet closed on the proposed convertible debt financing announced in early October. The Company is making every effort to keep its options open and that we have any and all necessary funding options available should we decide to proceed down this path.”

NOT FOR DISSEMINATION OR RELEASE IN THE UNITED STATES FOR IMMEDIATE RELEASE IN CANADA

For additional information contact: Sean Schaeffer, President, ZoomAway Inc., at 775-691-8860 | sean@zoomaway.com or stay up-to-date and sign up for our newsletter.

About Us

ZoomAway, Inc. (Nevada Co.) provides leading hotels, golf resorts, ski resorts, and activity providers with a seamless, scalable, and fully integrated technology platform that allows for the discounted packaging of lodging, ski, golf, activities, and attractions. It seamlessly integrates into client websites, providing their customers with a real time one-stop shop for all of their travel and recreational needs. Additional information about ZoomAway Inc. can be found at www.zoomaway.com.

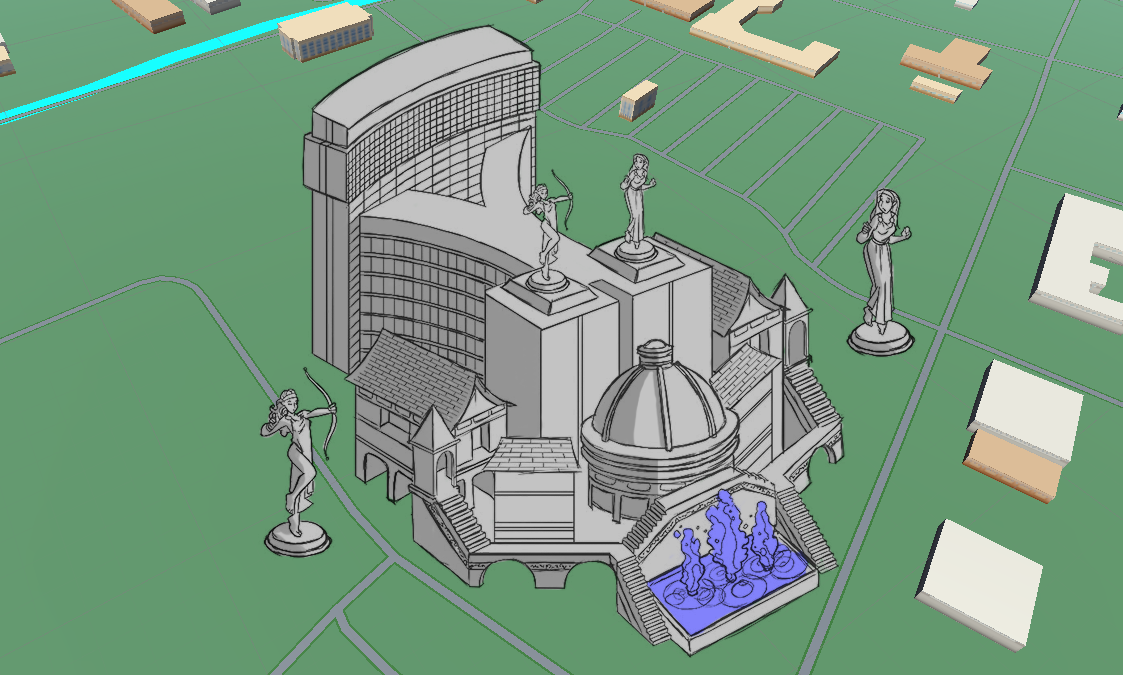

Travel Game Blockchain Inc. (Canadian Co.) is a new ZoomAway Travel, Inc. subsidiary company dedicated to housing new projects in the digital games and blockchain formats. The companies first proposed project is ZoomedOUT which can be seen at www.zoomedout.io. To receive more detailed, or investor level information, please contact us at info@zoomedout.io and we will respond with the appropriate documentation depending on your request.

About Zero8

Zero8 Studios, based in Reno, Nevada, specializes in new and innovative games and technology platforms. With a focus on social gaming and almost two decades of experience building countless game titles, gaming platforms, and various technologies. The Zero8 Studios’ team has assisted dozens of AAA publishers, large clientele, manufacturers, and casinos in the design, production, and delivery of their products to players around the world. Additional information can be found at www.zero8studios.com

Forward-Looking Statements

This release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include regulatory actions, market prices, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed Offering and has neither approved nor disapproved the contents of this press release.

Recent Comments