VANCOUVER, BC – November 6, 2023 – ZoomAway Technologies Inc. (TSXV: ZMA) (US: ZMWYF) (the “Company” or “ZMA”) www.zoomaway.com, is pleased to announce that it intends to complete a non-brokered private placement of 3,000,000 units of the Company (the “Units”) at a price of $0.05 per Unit for total gross proceeds of $150,000.00 (the “Private Placement”). Each Unit will consist of one common share and one common share purchase warrant, each whole warrant being exercisable for one common share at a price of $0.05 for a period of 5 years. The proceeds of the Private Placement will be used for working capital purposes only.

AIP Convertible Private Debt Fund LP (“AIP”), the Company’s major shareholder and principal lender, has agreed to subscribe to all of the Units to be offered pursuant to the Private Placement. As a result, the Private Placement constitutes a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company intends to rely on the exemptions from formal valuation and minority shareholder approval of the Private Placement contained in Sections 5.5(c) and 5.7(b),

respectively, of MI 61-101. AIP currently owns 46.96% of the Company’s issued and outstanding commons shares. As a result of the Private Placement,

AIP’s ownership will increase to 55.19% of the Company’s issued and outstanding common shares on a non-diluted basis and to 70.77% on a fully diluted basis (taking into account existing warrants held by AIP and the warrants to be issued as part of the Units). Neither the Company nor, to the knowledge of the Company after reasonable inquiry, AIP has knowledge of any material information concerning the Company or its securities that has not been generally disclosed. The Company has two independent directors, both of whom approve of the Private Placement. None of the proceeds from the Private Placement will be applied towards any amounts owed to AIP.

All securities issued pursuant to the Private Placement will be subject to a hold period of four months and one day from the date of issuance. The Private Placement is subject to regulatory approval, including the approval of the TSX Venture Exchange.

For additional information contact: Sean Schaeffer, President, ZoomAway Inc., at 775-691-8860 | sean@zoomaway.com or stay up-to-date and sign up for our newsletter.

About Us

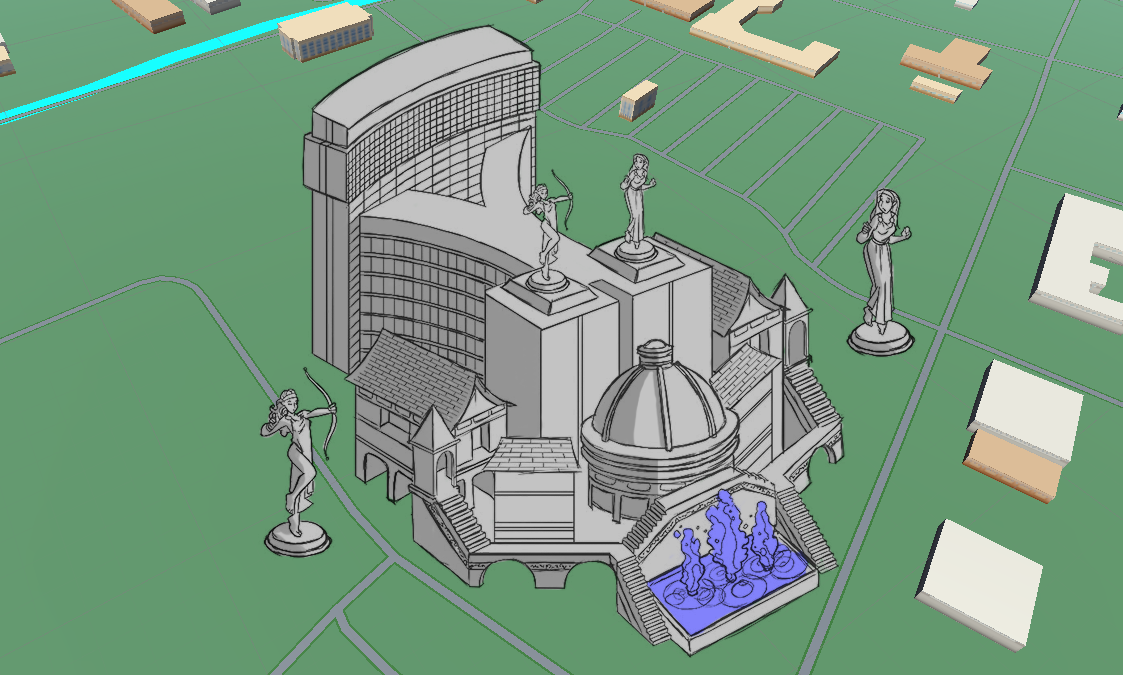

Zoomaway Technologies Inc. is a technology company principally involved in the hospitality and travel industries. We have developed a variety of software solutions that enhance the planning and engagement of everyday tourists. Our flagship project, ZoomedOUT, is a complete modernization and re-imagination of mobile travel apps. In a full 3D environment, we are able to integrate planning, booking, social media, and camaraderie into a tangibly rewarding experience. The Company has combined travel, hospitality, mobile gaming and augmented reality to change the way users travel. Additional information about ZoomAway Technologies Inc. can be found at www.zoomaway.com.

Forward-Looking Statements

This release contains “forward-looking information” or “forward-looking statements” within the meaning of applicable securities laws, including statements regarding the Transaction, the spin-off of ZMA’s current business, ZMA’s intention to continue to seek out other acquisition opportunities, the resumption of trading of the Company’s shares, the completion of due diligence, the execution of a definitive agreement in respect of the Transaction and the timing thereof, and receipt of shareholder approval and regulatory approvals including approval of the TSXV and the timing thereof. All statements in this release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include inability to secure funding for the Transaction, failure to obtain shareholder or regulatory approvals for the Transaction, regulatory actions, market prices, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates, and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.