VANCOUVER, BC / ACCESSWIRE / May 6, 2024 / ZoomAway Technologies Inc. (TSXV:ZMA)(OTC PINK:ZMWYF) (the “Company” or “ZMA“), a retail and hospitality technology development company, announces that it intends to pursue a change of business from a technology issuer to an investment issuer on the TSX Venture Exchange (“Exchange“). The Board and management of the Company believe that undertaking a change of business is in the best interest of the Company.

Since Q1 of 2022, the Board and management of the Company have been looking for strategic acquisitions and opportunities to create value. In April of 2022, the Company announced a binding letter of intent that resulted in a halt on its shares. On October 24th, 2023, the Company announced that it had chosen not to pursue a previously announced acquisition and had subsequently applied to the Exchange to re-instate the trading of its shares. Trading of the Company shares resumed on October 26, 2023.

In the period following October 26, 2023, the Company attempted to identify suitable acquisition targets while continuing to operate its traditional business. As part of this process, Messrs. Jay Bala and Alex Kanayev, principals at AIP Asset Management Inc. (“AIP“), and two of the directors of the Company, proposed the possibility of pursuing a change of business of the Company to that of an investment issuer with the objective of investing in equity, debt and/or other securities of high growth late-stage private businesses, including, in particular, pre-IPO companies. The proposal was considered by the Board of Directors, including the independent directors of the Company, and the Board decided to pursue the possibility of undertaking the change of business, subject to the negotiation of appropriate agreements, a capital raise to fund the proposed change of business, and the receipt of all applicable corporate and regulatory approvals, including that of the shareholders of the Company and the Exchange. There can be no assurance that the proposed change of business will be completed as proposed or at all.

Trading in the securities of the Company is currently halted and is expected to remain halted until the completion of the proposed change of business or the decision of the Board of Directors of the Company to abandon this initiative.

No agreement has been entered into between the Company and AIP. However, it is currently contemplated that AIP will act as manager to the Company, which is intended to be renamed “Access Pre-IPOs” (“Access“), to source and advise with respect to all investments. It is anticipated that the Company will pay AIP a 2.5% management fee based upon the Company’s investment portfolio. AIP will also assist Access in the elaboration of an investment policy. Subject to compliance with applicable law, Access may make an investment in a business or company that ranges from a minority position to one of significant influence, including as a control person. The traditional business carried on by ZMA through its current operating subsidiary will constitute the initial control position of Access until a decision is taken with respect to a possible disposition or spin out of the ZoomAway business. The negotiation and signature of a management agreement with AIP will be undertaken by the independent directors of the Company in connection with the proposed change of business.

The proposed change of business to Access will also entail shareholder approval for, among other matters, the change of the corporate name from “ZoomAway Technologies Inc.” to “Access Pre-IPOs”, as well as a consolidation of the issued and outstanding common shares of the Company in order to accommodate a proposed financing (see “Proposed Financing” below). Based upon the current trading range of the Company’s common shares on the Exchange, the Company is considering a consolidation ratio of up to 200:1.

Proposed Board and Management of Access

The Board of Directors of Access is expected to consist of (i) Mr. Jay Bala, a current director of the Company, (ii) Mr. Alex Kanayev, a current director of the Company, (iii) Mr. John Cooper, a new proposed independent director, (iv) Mr. Richard Stone, a new proposed independent director, and (v) Mr. Mason Shan, a current independent director on the Company.

Jay Bala, CEO and Director

Mr. Jay Bala, CFA, a current director of the Company and co-founder, CEO and Senior Portfolio Manager of AIP, is expected to act as the CEO of Access.

Mr. Bala is a member of the board of directors at several publicly listed companies. He has prior experience working at a large family office, equity research at an investment bank and a prominent private debt fund. Mr. Bala holds a Bachelor of Commerce from the University of Toronto and is a CFA charter holder. In 2014, Mr. Bala was a nominee for the Ernst & Young Entrepreneur of the Year Award.

Assuming the change of business to Access, Mr. Sean Schaeffer, the current CEO of the Company, will step down as CEO and director of the Company, however Mr. Shaeffer will continue to lead the Company’s current operating Nevada subsidiary, ZoomAway, Inc.

Alex Kanayev, CFO and Director

Mr. Alex Kanayev, MBA, CPA, ICD.D, a current director of the Company and co-founder and Chairman of AIP, is expected to act as the CFO of Access. Mr. Kanayev is a co-founder & Chairman of AIP and a Member of the AIP Advisory Board. He sits on the board of several companies and is Managing Partner at AIP Private Capital. Previously, he was the SVP at a prominent Private Debt Fund and Portfolio Manager at BMO Financial Group. Mr. Kanayev received his MBA from Schulich School of Business at York University and is a CPA charter holder and has an ICD.D designation from the Institute of Corporate Directors. In 2014, Mr. Kanayev was a nominee for the Ernst & Young Entrepreneur of the Year Award.

Assuming the change of business to Access, Mr. Steven Rosenthal, the current CFO of the Company, will step down as CFO and director of the Company, however Mr. Rosenthal will continue as CFO of the Company’s current operating Nevada subsidiary, ZoomAway, Inc.

John Cooper, Director

Mr. John Cooper was previously President of MSIM Distributors at Morgan Stanley Investment Management, President & CEO of Invesco Distributors, Head of Retail National Accounts at Legg Mason and held several roles at Putnam Investments.

Mr. Cooper serves on a number of other Financial Services and FinTech advisory boards, and also serves as an ETF Fund Board Director for THOR Financial Technologies. He holds a BS from Boston College, where he double majored in Marketing and Human Resources Management, was a standout athlete in football and baseball, and was inducted into their Varsity Club Athletic Hall of Fame.

Richard Stone, Director

Mr. Richard Stone is a highly experienced financial services executive, starting his career in 1979. In 1994 he founded Stone Asset Management Limited serving as Chairperson, CEO and CIO. Mr. Stone as a board member, has experience in private, public and philanthropic boards. He holds the Institute of Corporate Directors designation (ICD.D), and currently serves as an Independent Director of Eloro Resources Ltd., a TSX-listed firm and Foster & Associates Financial Services as Chairperson.

Mason Shan, Director

Mr. Umeshan Shanmugadasan (“Mason Shan”) is a lawyer (J.D.) who resides in Toronto, Ontario, and brings more than 15 years of experience in legal matters. Mr. Shan has spent his private practice career at top tier law firms in Toronto and Calgary working in both the mining and oil industry, respectively. In the later years of his career he has served as counsel for public and private companies in the pharmaceutical and medical technology industries. He now serves as counsel for a public consumer products and goods company in the hygiene, wellness and nourishment industry. He has experience in advising senior management and boards on various legal and compliance issues that companies face. His legal expertise specializes in securities, mergers and acquisitions, corporate/commercial, private equity and asset management.

Proposed Financing

In connection with the proposed change of business to Access, the Company is looking to arrange a non-brokered private placement offering, with Oak Hill Asset Management Inc. as the lead agent (“Agent“), of up to 2,500,000 subscription receipts (“Subscription Receipts“), at a price of $10.00 per Subscription Receipt, for gross proceeds of up to $25,000,000, or such other amount as may be agreed to by the Company and the Agent (the “Offering“).

The net proceeds of the Offering will be used (i) to fund the core business of Access following the change of business of the Company, namely to invest in equity, debt and/or other securities of high growth late stage private businesses, and (ii) for working capital and other general corporate purposes.

Each Subscription Receipt shall be deemed to be converted, without payment of any additional consideration and without further action on the part of the holder thereof, for one unit (a “Unit“) upon satisfaction of the Escrow Release Conditions (as defined below), subject to adjustment in certain events. Each Unit, is comprised of one post-consolidation common share (a “Resulting Issuer Share“) pursuant to the change of business.

The Company will pay the Agent a fee equal to up to 8% of the aggregate gross proceeds of the Offering payable in cash (the “Cash Commission“). The Cash Commission is earned on the Closing Date and will be payable on satisfaction of the Escrow Release Conditions. In addition, the Agent will receive warrants (the “Compensation Warrants“) equal to 8% of the number of Subscription Receipts sold pursuant to the Offering on the Closing Date. Each Compensation Warrant will be exchanged for one compensation warrant of Access (each, a “Resulting Issuer Compensation Warrant“) upon the satisfaction of the Escrow Release Conditions.

Each Resulting Issuer Compensation Warrant shall entitle the holder thereof to subscribe for one Resulting Issuer Share at a price equal to $11.50 for a period of 24 months from the date the Resulting Issuer Shares are listed on the Exchange.

On the Closing Date, the gross proceeds of the Offering less: (i) 50% of the Cash Commission; and (ii) 100% of the Agent’s expenses incurred up to the closing date, will be held in escrow (the “Escrowed Funds“) by a Canadian trust company or other escrow agent (the “Escrow Agent“) acceptable to the Company and the Agent and invested as pursuant to the terms of a subscription receipt agreement (the “Subscription Receipt Agreement“).

If (i) the Escrow Release Conditions (as defined below) are not satisfied on or before the date that is 120 days from the closing date (the “Escrow Deadline“), which may be further extended, at the sole and absolute discretion of the Agent or the Company, by a period of 60 days, or (ii) if prior to the Escrow Deadline, the proposed change of business is terminated or the Company has advised the Escrow Agent and the Agent that the change of business will not be completed, the Escrowed Funds, less any expenses incurred by the Agent after the closing date, shall be returned to the holders of Subscription Receipts, within two business days of the Escrow Deadline pro rata plus a pro rata portion of any interest earned thereon (net of any applicable withholding tax). To the extent that the Escrowed Funds (plus accrued interest) are not sufficient to purchase all of the Subscription Receipts on the foregoing terms, the Company will contribute such amounts as are necessary to satisfy any shortfall, such that each holder of Subscription Receipts shall receive an amount equal to the Issue Price per Subscription Receipt.

It is expected that the escrow release conditions (“Escrow Release Conditions“) will include that all conditions precedent to the completion of the change of business, other than the release of the Escrowed Funds, shall have been satisfied to the satisfaction of, or waived by, the Agent including, without limitation: (i) any necessary government and regulatory approvals; (ii) any required shareholder approvals; and (iii) the conditional approval of the Exchange of the change of business and the listing of the Resulting Issuer Common Shares to be issued to the holders of the Subscription Receipts, and the completion, satisfaction or waiver of all conditions precedent to such listing, other than the release of the Escrowed Funds.

Assuming the completion of the proposed change of business, including an up to 200 to 1 consolidation of the common shares of the Company, and the closing of the Offering in the maximum amount, Access, as the resulting issuer from the change of business, would have approximately 2,631,655 Resulting Issuer Shares, of which (i) 43,313 Resulting Issuer Shares are expected to be held by the current shareholders of the Company, excluding AIP Convertible Debt Fund LP (the “Fund“), (ii) 2,500,000 Resulting Issuer Shares are expected to be held by subscribers to the Offering, and (iii) 88,342 Resulting Issuer Shares are expected to be held by the Fund.

Additional Proposed Transactions with AIP Convertible Debt Fund LP

In addition, the Company is pleased to announce that AIP, in its capacity as security agent for the Fund, has agreed in principle to the following proposed amendments to certain loan arrangements between the Fund and the Company:

- Secured loan facility for the principal amount of $6.38 million with the Fund. The Facility has a term of 24 months, bears interest at the rate of 5% per annum and is secured by a general security agreement on all of the present and future assets of the Company. The balance of $6,380,000 was due on April 30, 2024. The Fund is proposing to extend the maturity date for the balance of $6,571,400 to June 30, 2024;

- Bridge loan facility for the principal amount of US$500,000 with the Fund. The facility bears interest at a rate of 12% per annum and matured on April 30, 2024. The Fund is proposing to convert the principal amount into CDN$700,000 and then to convert $350,000 of the balance into 7,000,000 common shares of the Company and to extend the payment date for the balance and outstanding interest to June 30, 2024;

- On August 21, 2023, AIP agreed to provide the Company with an additional loan in the amount of USD $400,000. This note bears interest at a rate of 12% per annum. The loan matured on January 31, 2024, at which time the entire principal balance was due along with any outstanding interest. The Fund is proposing to extend the payment date for the balance of $385,000 and outstanding interest to June 30, 2024; and

- The Fund is proposing to cancel the 7,301,852 warrants to acquire 7,301,852 Shares at a price of $0.45 at any time prior to February 16, 2026 that it currently holds.

Existing Assets and Liabilities Moved to Nevada Operating Subsidiary

In connection with the proposed change of business and the Offering, AIP and the Fund intend to enter into a debt restructuring agreement with the Company in respect of the balance of the secured loan facility such that the obligations and the security would only charge the Company’s current operating Nevada subsidiary, ZoomAway, Inc. As a result of this proposed debt restructuring, the closing of the Offering and the proposed change of business of the Company, it is expected that Access, as the resulting issuer, will have no exposure to the existing liabilities of the Company toward the Fund.

The foregoing proposed transactions with AIP and the Fund, which would be considered related party transactions pursuant to MI 61-101, are subject to the acceptance of the Exchange and compliance with the formal valuation and majority of the minority shareholder approval provisions of MI 61-101 and Exchange Policy 5.9. The Company benefits an exemption from the formal valuation requirements pursuant to section 5.5(b) of MI 61-101. The Company will be providing an update to shareholders in a subsequent release. Messrs. Bala and Kanayev have not and will not participate in any Board of Directors decisions relating to the proposed transactions between the Company and AIP and the Fund.

For additional information contact: Sean Schaeffer, President, ZoomAway Inc., at 775-691-8860 | sean@zoomaway.com or stay up-to-date and sign up for our newsletter.

About Us

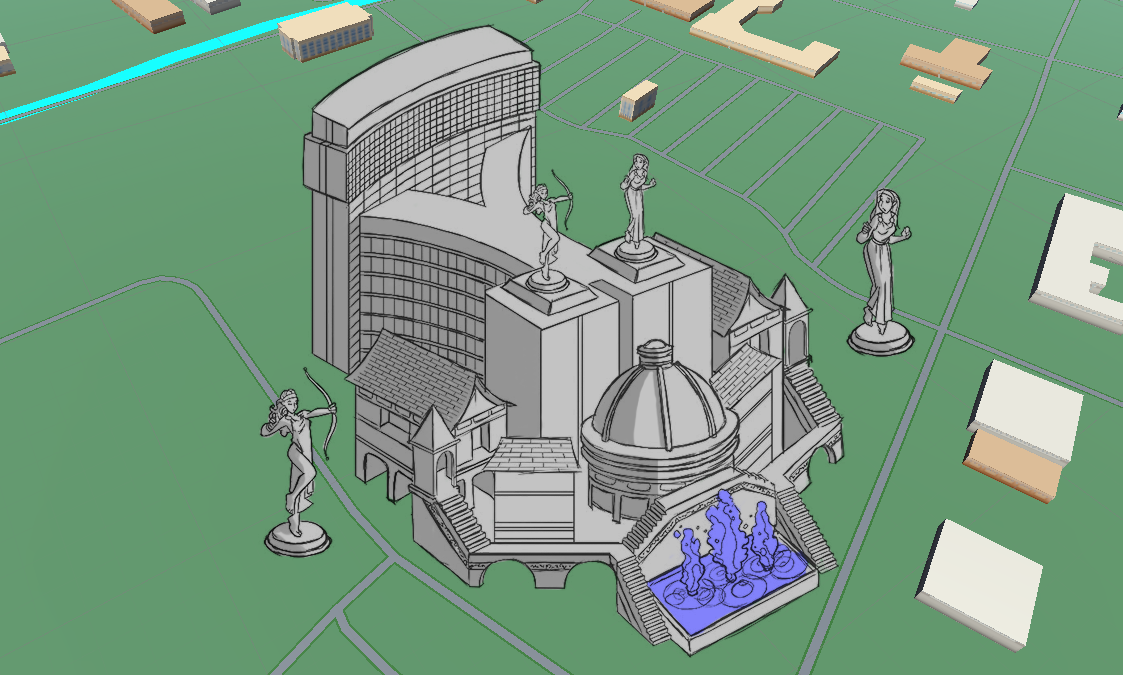

Zoomaway Technologies Inc. is a technology company principally involved in the hospitality and travel industries. We have developed a variety of software solutions that enhance the planning and engagement of everyday tourists. Our flagship project, ZoomedOUT, is a complete modernization and re-imagination of mobile travel apps. In a full 3D environment, we are able to integrate planning, booking, social media, and camaraderie into a tangibly rewarding experience. The Company has combined travel, hospitality, mobile gaming and augmented reality to change the way users travel. Additional information about ZoomAway Technologies Inc. can be found at www.zoomaway.com.

Forward-Looking Statements

This release contains “forward-looking information” or “forward-looking statements” within the meaning of applicable securities laws, including statements regarding the Transaction, the spin-off of ZMA’s current business, ZMA’s intention to continue to seek out other acquisition opportunities, the resumption of trading of the Company’s shares, the completion of due diligence, the execution of a definitive agreement in respect of the Transaction and the timing thereof, and receipt of shareholder approval and regulatory approvals including approval of the TSXV and the timing thereof. All statements in this release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”,“estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”,“may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include inability to secure funding for the Transaction, failure to obtain shareholder or regulatory approvals for the Transaction, regulatory actions, market prices, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking tatements. Forward-looking statements are based on the beliefs, estimates, and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.