VANCOUVER, BC / ACCESSWIRE / February 16, 2021 / ZoomAway Travel Inc. (TSXV:ZMA)(OTCQB:ZMWYF) (the “Company” or “ZMA“) www.zoomaway.com, is pleased to announce that it has closed its previously announced shares-for-debt transaction with AIP Convertible Private Debt Fund LP (“AIP“) pursuant to which the Company settled $985,750 of maturing debt by the issuance to AIP of a total of 65,716,666 common shares of the Company at a deemed price of $0.015 per share and 65,716,666 common share purchase warrants (the “Debt Settlement“). Each warrant is exercisable for a period of 60 months from the date of issuance at an exercise price of $0.05 each. After giving effect to the Debt Settlement, the Company has a total of approximately 153,360,338 shares issued and outstanding, with AIP holding approximately 45.00% on an undiluted basis.

The Debt Settlement has resulted in the creation of AIP as a new “Control Person” (as such term is defined in the policies of the TSX Venture Exchange (the “TSXV“)) of the Company. In accordance with the policies of the TSXV, the disinterested shareholders of the Company overwhelming approved the Debt Settlement and the creation of a new “Control Person” in AIP at the Company’s annual and special meeting of shareholders held on December 16, 2020.

All of the securities issued pursuant to the Debt Settlement are subject to a hold period of four months and one day from the date of issuance.

The pricing of the common shares issuable pursuant to the Debt Settlement is in reliance of the temporary relief measures established by the TSXV on April 8, 2020, and extended by the TSXV on September 16, 2020 and December 15, 2020, providing for temporary relief measures to its Policy 4.3, lowering the minimum pricing from $0.05 to $0.01 per share for shares issued pursuant to a debt settlement where the market price of an issuer’s shares is not greater than $0.05.

In connection with the Debt Settlement, AIP acquired ownership, control or direction over common shares of the Company requiring disclosure pursuant to the early warning requirements of applicable securities regulation. Immediately prior to the Debt Settlement, AIP had ownership of, or exercised control or direction over, approximately 3,300,000 voting or equity shares of the Company. AIP acquired ownership of an additional 65,716,666 common shares of the Company representing approximately 42.85% of the Company’s issued and outstanding common shares and now holds approximately 45.00% of the issued and outstanding common shares of the Company.

The Company understands that AIP acquired the aforementioned securities for investment purposes and may, from time to time and depending on market and other conditions and subject to the requirements of applicable securities laws, acquire additional common shares through market transactions, private agreements, treasury issuances or otherwise, or may, subject to the requirements of applicable securities laws, sell all or some portion of the common shares they own or control, or may continue to hold the common shares.

This portion of this news release is issued pursuant to National Instrument 62-103 – The Early Warning System and Related and Take-Over Bid and Insider Reporting Issues of the Canadian Securities Administrators, which also requires an early warning report to be filed with the applicable securities regulators containing additional information with respect to the foregoing matters. A copy of the early warning report will be filed by AIP in accordance with applicable securities laws and will be available on the Company’s issuer profile on SEDAR at www.sedar.com.

For additional information contact: Sean Schaeffer, President, ZoomAway Inc., at 775-691-8860 | sean@zoomaway.com or stay up-to-date and sign up for our newsletter.

About Us

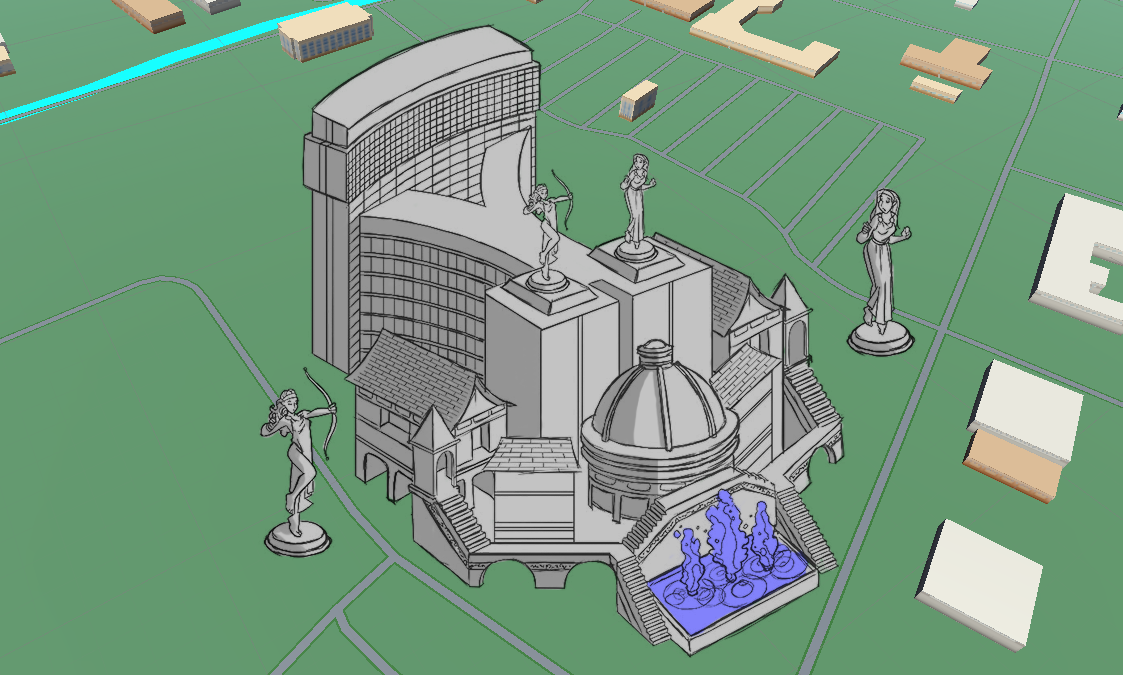

ZoomAway, Inc. (Nevada Co.) Zoomaway Travel Inc. is a technology company that is revolutionizing the Hospitality and Travel Industries. We have developed a variety of software solutions that enhance the planning and engagement of everyday tourists. Our flagship project, ZoomedOUT, is a complete modernization and re-imagination of mobile travel apps. In a full 3D environment, we are able to integrate planning, booking, social media, and camaraderie into a tangibly rewarding experience. We are combining Travel, Hospitality, Mobile Gaming and Augmented Reality to change the way users travel into 2020 and beyond. Additional information about ZoomAway Inc. can be found at www.zoomaway.com.

ZMA Travel Game Inc. (Canadian Co.) (formerly TravelGameBlockChain Technology Inc.) is a ZoomAway Travel Inc. subsidiary company dedicated to housing new projects in the digital games. The company’s first project is ZoomedOUT, being developed with the assistance of Zero8 Studios, Inc., which can be seen at zoomedout.io. To receive more detailed, or investor level information, please contact us at sean@zoomaway.com and we will respond with the appropriate documentation depending on your request.

Forward-Looking Statements

This release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include regulatory actions, market prices, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates, and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Neither the TSX Venture Exchange nor it’s Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed Offering and has neither approved nor disapproved the contents of this press release.